OpenClaw: AI Agent That Ships Code While You Sleep (2026)

Bradley Herman

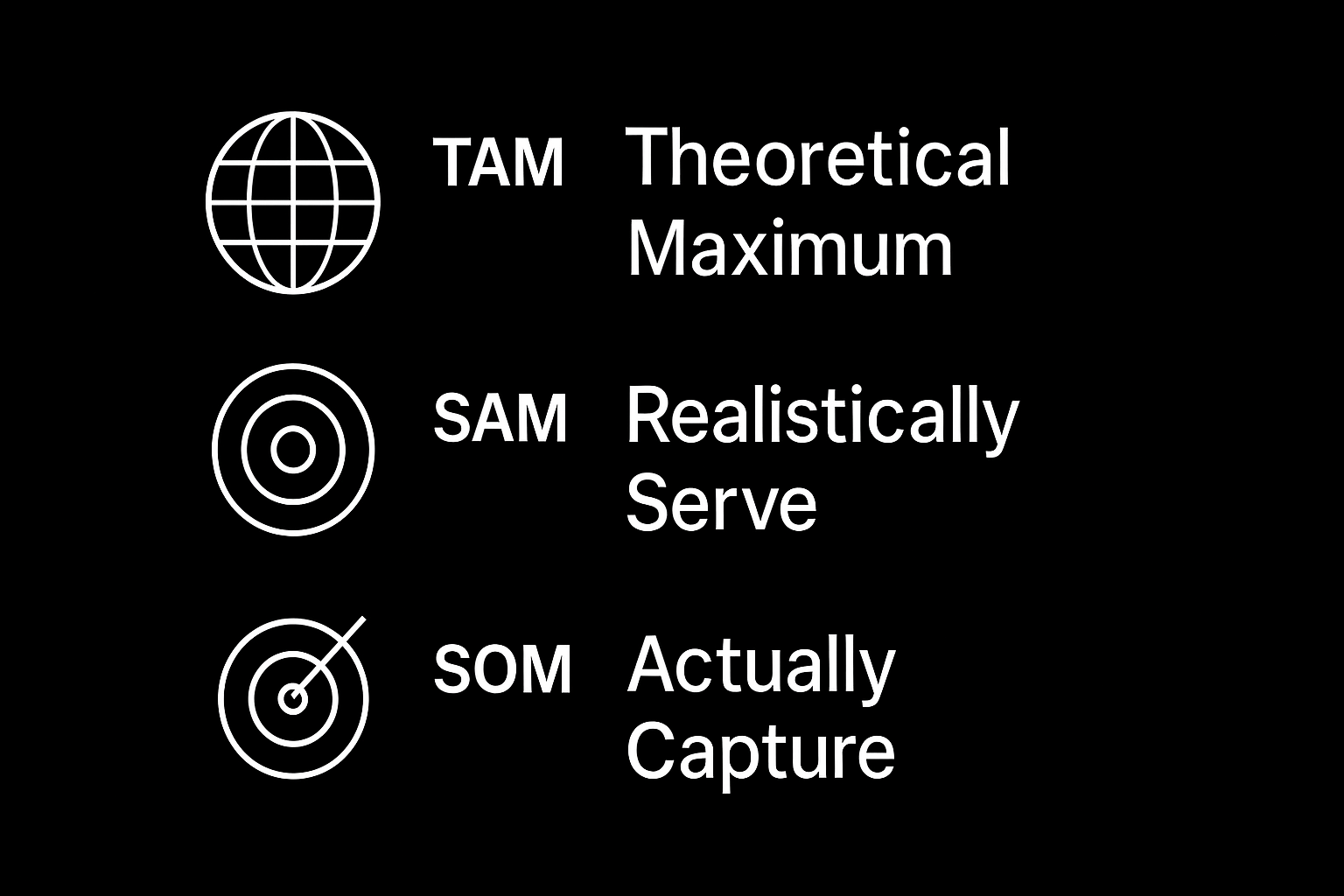

TAM SAM SOM is a three-tier market sizing framework that helps startups communicate their business opportunity to investors and plan their growth strategy. TAM represents your theoretical maximum market size, SAM is the portion you can realistically serve, and SOM is what you can actually capture in the near term: think of it as going from "if we owned the entire world" to "what we can win next year."

TAM SAM SOM creates a hierarchy that moves from theoretical possibility to practical execution. This isn't just an academic exercise: it's how investors evaluate whether your startup is worth their time and money, and how you should think about resource allocation and go-to-market strategy.

Total Addressable Market (TAM) answers the question: "How big could this get if we had unlimited resources and no competition?" This represents the total revenue opportunity if your company captured 100% market share across everyone who could theoretically use your product. For a project management tool, TAM might include every business globally that manages projects.

Serviceable Addressable Market (SAM) gets more realistic by asking: "What portion can we actually serve given our business model, geographic reach, and target customers?" This filters TAM down to segments you can realistically address. That same project management tool might focus on English-speaking markets with teams of 10-100 people, significantly reducing the addressable market from TAM.

Serviceable Obtainable Market (SOM) brings you to execution reality: "What can we realistically capture in the next 2-3 years given our resources and competition?" This represents your actual business opportunity based on your go-to-market strategy, competitive landscape, and operational capacity.

The relationship follows a strict hierarchy: SOM ⊆ SAM ⊆ TAM. Each metric should be smaller than the one above it, with credible SOM ratios typically representing 1-10% of SAM for credibility with investors.

Why this matters for business planning: These numbers directly influence critical decisions. A large TAM might justify venture funding, but your SOM determines your actual revenue projections and hiring plans. The ratio between them shows investors how you think about market penetration and competitive positioning.

Calculation methodology matters more than the numbers themselves. Building credible market size estimates requires specific steps:

Instead of saying "the project management market is $5B and we'll capture 1%," build from specific customer counts: "We identified 2,500 companies in our target segment, each spending an average of $12,000 annually on project management tools." Use credible sources like industry research from Gartner, IDC, or Forrester to validate your assumptions.

Common pitfalls can kill your credibility fast. The biggest mistakes aren't mathematical; they're communication failures:

Those who present well-researched, conservative estimates with clear methodology demonstrate market understanding and coachability.

Integration with go-to-market strategy makes these numbers actionable rather than theoretical. Your SOM should directly align with your customer acquisition plan, sales capacity, and resource allocation. If your SOM assumes capturing 500 customers but your go-to-market plan can only reach 100, something needs adjustment.

"Bigger numbers are always better" - Investors actually prefer realistic, well-researched smaller markets over inflated global estimates. A founder who says "we're targeting the $500B global software market" sounds less credible than one who says "we're focused on the $50M market for project management tools in mid-size US companies."

"TAM SAM SOM is just for investor pitches" - These metrics should drive internal decision-making about product development, hiring, and resource allocation. If your internal planning doesn't match your investor presentations, you're either misleading investors or misallocating resources.

A startup building AI-powered customer support tools might calculate:

TAM: All global businesses that provide customer support = 50M companies × $2,000 average annual spend = $100B

SAM: English-speaking B2B SaaS companies with 10+ support tickets daily = 25,000 companies × $8,000 average spend = $200M

SOM: Companies we can reach through our go-to-market channels in first 18 months = 500 companies × $8,000 = $4M

Notice how each level gets more specific and realistic. The founder can explain exactly why they filtered from 50M companies to 25,000 to 500, with clear reasoning for each constraint.

Sergey Kaplich