OpenClaw: AI Agent That Ships Code While You Sleep (2026)

Bradley Herman

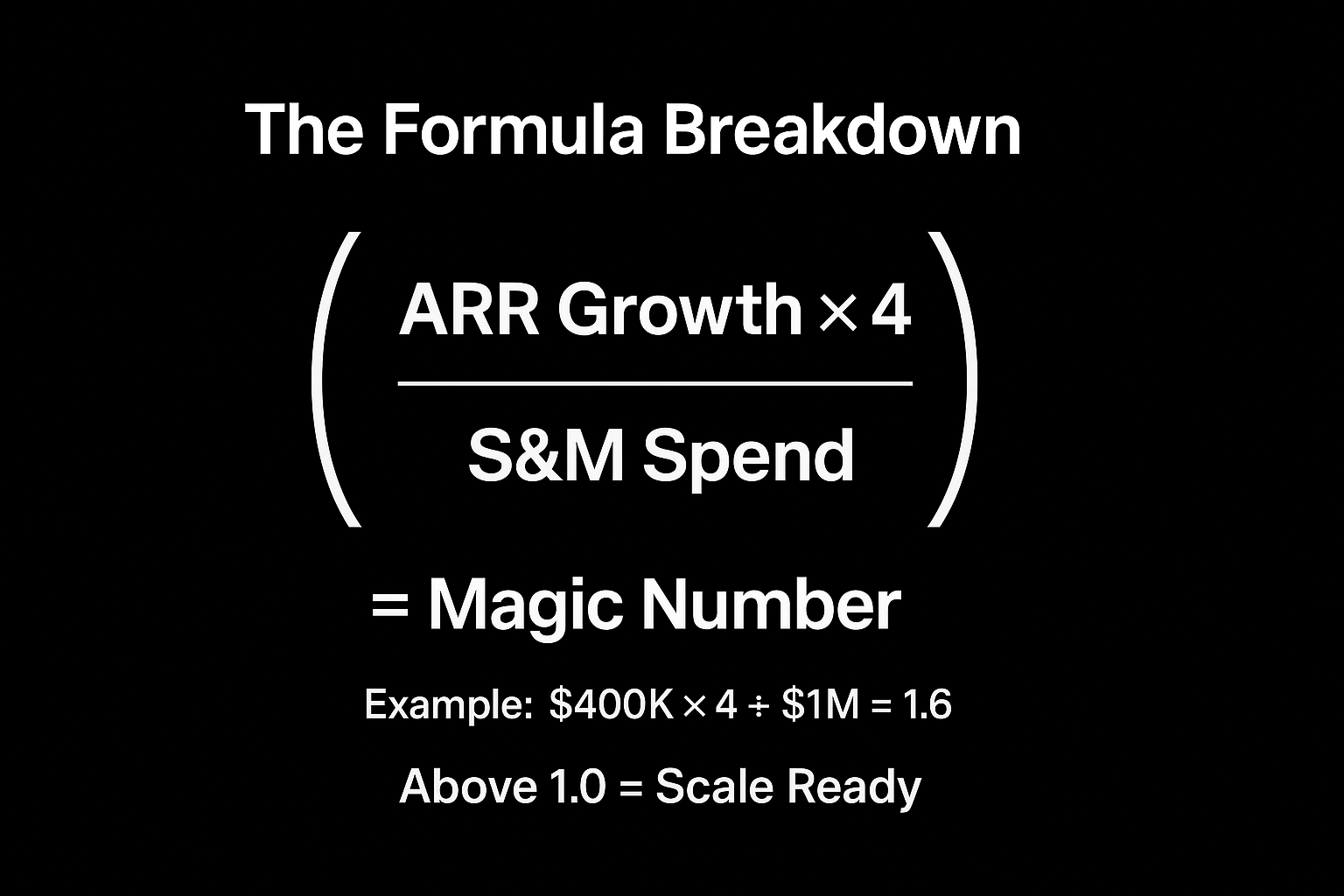

The Magic Number measures how efficiently your SaaS company converts sales and marketing spending into new recurring revenue. Calculate it by taking your quarterly ARR growth, annualizing it (multiply by 4), then dividing by your previous quarter's S&M spend. A score above 1.0 means you're generating more than $1 of new ARR for every dollar spent: the threshold most VCs use to approve aggressive scaling.

Think of the Magic Number as your go-to-market efficiency speedometer. Just like monitoring your application's response time tells you when to scale your infrastructure, this metric tells you when to scale your sales and marketing efforts.

The calculation: [(Current Quarter ARR - Previous Quarter ARR) × 4] ÷ Previous Quarter S&M Spend

The multiplication by 4 converts your quarterly growth into an annual figure, making it comparable across companies and time periods. This annualization allows you to measure how much ARR you generate for every dollar spent on sales and marketing, regardless of seasonal variations or quarterly fluctuations.

The SaaS requires careful efficiency monitoring: current data shows the median Magic Number at 0.90, meaning most companies generate $0.90 in net new ARR for every dollar spent on sales and marketing. Understanding your position relative to these benchmarks helps you make smarter scaling decisions.

Performance benchmarks give you clear thresholds for action provides decision frameworks for technical founders making scaling investment decisions:

These thresholds help you make informed decisions about when to invest more heavily in sales and marketing versus focusing on product improvements or operational efficiency.

Common mistakes: focusing on symptoms rather than root causes. Many founders see a good Magic Number and assume their sales team is performing well, when the real driver might be product-led growth or viral adoption. The most dangerous error is treating correlation as causation, just because ARR grew after increasing marketing spend doesn't prove the spending caused the growth.

Stage-based expectations matter: Early-stage companies typically see lower numbers due to founder involvement and unstable processes. Growth-stage companies should target higher efficiency, while mature companies often achieve the best performance as they optimize for profitability over pure growth.

The metric becomes your scaling decision engine. VCs use Magic Number thresholds to approve scaling investments: above 1.0 gets funding approval, below 0.75 triggers strategic intervention. Public companies including MuleSoft, New Relic, and Snowflake have restructured entire go-to-market approaches based on declining Magic Numbers.

"Magic Number proves my marketing is working" - This assumes causation where there's only correlation. Your growth might come from product virality, word-of-mouth, or organic channels rather than paid marketing efforts. Product-led growth companies are especially vulnerable to this misattribution.

"A good Magic Number means I'm profitable" - The formula ignores gross margins entirely, which can create dangerous blind spots. A Magic Number of 1.0 with 60% gross margins means you're actually paying back acquisition costs based on gross profit, not revenue, extending your true payback period significantly.

Key profitability considerations:

This metric should be viewed as one piece of your financial analysis, not a standalone indicator of business health.

"I should include expansion revenue" - The cleanest calculation focuses on net new ARR from new customers. Including expansion revenue from existing customers can mask poor acquisition efficiency by conflating customer success with sales and marketing effectiveness.

Alternative calculations provide different insights: The standard formula works for most cases, but companies with significant churn should use Net ARR (new ARR + expansion - contraction - churn) divided by S&M spend. This gives a more accurate picture when customer retention varies dramatically.

Mathematical relationships with other SaaS metrics: Magic Number has a direct inverse relationship with CAC payback period. The formula connecting them is: CAC Payback (months) ≈ 12 ÷ (Magic Number × Gross Margin). Understanding these mathematical relationships allows you to predict one metric from another and validate consistency across your unit economics model:

LTV:CAC ≈ (Average Customer Lifespan in months × Magic Number × Gross Margin) ÷ 12These mathematical connections provide a comprehensive view of your unit economics and help validate that your metrics are telling a consistent story.

Magic Number serves as your primary signal for scaling readiness, but it works best when combined with complementary metrics like CAC payback period and retention rates. Use it as your go-to-market efficiency compass, but always validate the underlying drivers before making major investment decisions.

Sergey Kaplich